MORTGAGE RATES SET TO RISE IN FOURTH QUARTER

Sep 17, 2018

from BCREA

Mortgage Rate Outlook

The Canadian mortgage market is undergoing significant tightening with the availability of credit falling and interest rates rising. The mortgage stress test introduced in January negatively impacted home sales nationwide as prospective homebuyers with more than 20 per cent down payments were denied access to loans they would have qualified for under the old regulatory regime. As a result, mortgage credit growth in Canada has slowed dramatically. On the pricing side, monetary policy continues to be the primary driver of higher mortgage rates in 2018 as the Bank of Canada embarks on its first tightening cycle since 2004. Although the 5-year qualifying rate was fairly steady over the third quarter, as the Bank continues to tighten, mortgage rates will almost certainly follow.

The Canadian mortgage market is undergoing significant tightening with the availability of credit falling and interest rates rising. The mortgage stress test introduced in January negatively impacted home sales nationwide as prospective homebuyers with more than 20 per cent down payments were denied access to loans they would have qualified for under the old regulatory regime. As a result, mortgage credit growth in Canada has slowed dramatically. On the pricing side, monetary policy continues to be the primary driver of higher mortgage rates in 2018 as the Bank of Canada embarks on its first tightening cycle since 2004. Although the 5-year qualifying rate was fairly steady over the third quarter, as the Bank continues to tighten, mortgage rates will almost certainly follow.

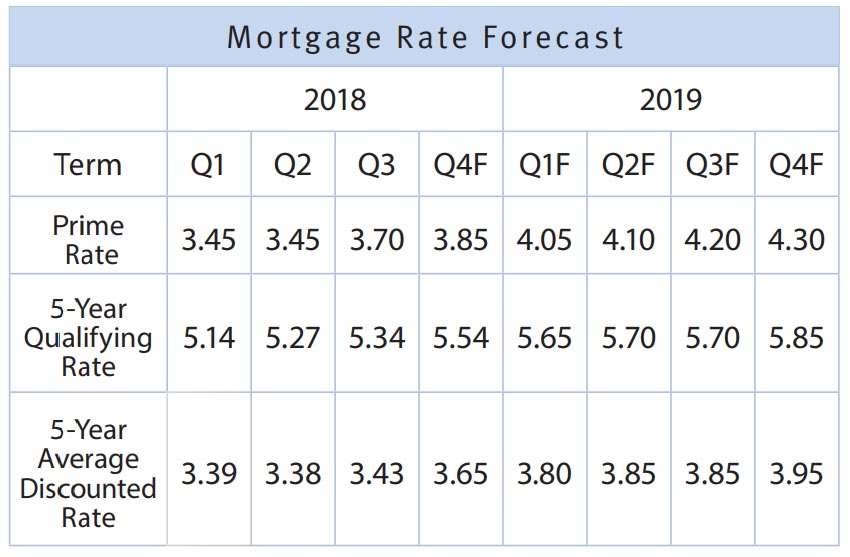

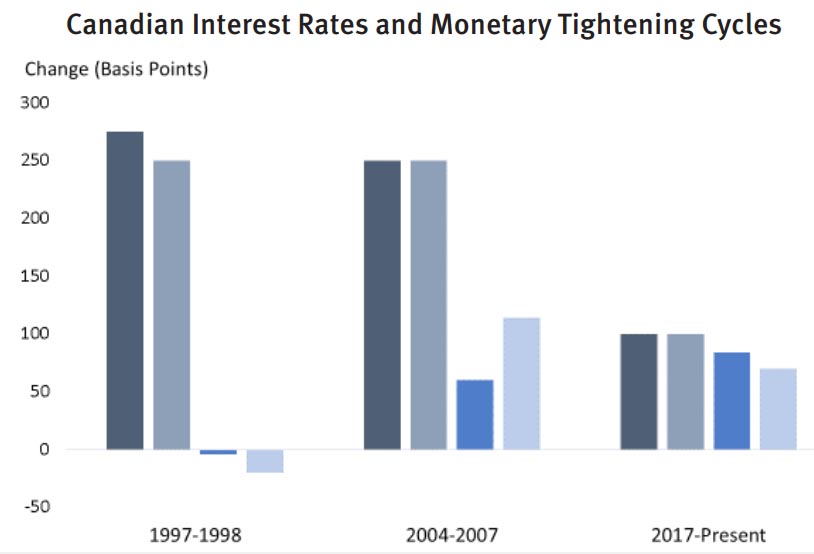

When the Bank of Canada adjusts its overnight rate, it influences borrowing rates throughout the economy. However, monetary policy is just one factor affecting 5-year borrowing rates and so, unlike variable rates, not only do fixed rates not correspond one-for-one with the overnight rate, they can sometimes differ in direction as well. Looking at past tightening cycles reveals that the behaviour of mortgage rates can sometimes be very different than what the central bank is targeting. For example, in the late 1990s, markets were anticipating a weakening economy, causing 5-year bond yields to stay flat and mortgage rates to decline despite the Bank raising rates by 275 basis points. Conversely, from 2004 to 2007, tightening by the Bank of Canada had a more conventional impact on long-term borrowing rates. In fact, mortgage rates rose by considerably more than its benchmark, the 5-year bond yield, due to heightened credit risk in the period leading up to the 2007 financial crisis. Since the Bank embarked on its most recent tightening cycle in 2017, rates across the economy have risen almost in unison, which suggests that financial markets and policymakers share similar views on the Canadian economic outlook. As the Bank of Canada continues to tighten rates over the next two years, both the 5-year fixed qualifying rate and the 5-year discounted rate are forecast to reach 5.85 per cent and 3.95 per cent respectively in 2019.

Economic Outlook

The Canadian economy grew 2.9 per cent in the second quarter of 2018 and has grown at an average rate of 2.6 per cent over the past 8 quarters, well above the estimated long-run potential growth of 1.7 per cent. Looking ahead, the question remains how much longer above-trend growth can be sustained. The national unemployment rate appears to have reached bottom and core inflation is running at 2 per cent, consistent with an economy at full-employment. Rising interest rates, the mortgage stress test and tumultuous NAFTA negotiations all present challenges to further growth. We are forecasting that economic growth will slow from the 3 per cent rate posted in 2017, averaging about 2.3 per cent over the next two years.

The Canadian economy grew 2.9 per cent in the second quarter of 2018 and has grown at an average rate of 2.6 per cent over the past 8 quarters, well above the estimated long-run potential growth of 1.7 per cent. Looking ahead, the question remains how much longer above-trend growth can be sustained. The national unemployment rate appears to have reached bottom and core inflation is running at 2 per cent, consistent with an economy at full-employment. Rising interest rates, the mortgage stress test and tumultuous NAFTA negotiations all present challenges to further growth. We are forecasting that economic growth will slow from the 3 per cent rate posted in 2017, averaging about 2.3 per cent over the next two years.

Interest Rate Outlook

The Bank of Canada is determined to finally “normalize” monetary policy after nearly a decade of low interest rates with the goal of returning the overnight rate to its estimated equilibrium or “neutral” level of between 3 and 3.5 per cent. Policymakers at the Bank have even discussed dropping their gradual approach, replacing the standard 25 basis point increment rate increases with more accelerated interest rate increases.

The case for tighter policy is theoretically sound. Total CPI Inflation is near the top end of the Bank’s 1 to 3 per cent range and the economy is expanding at a rate above what the Bank estimates is consistent with its mandated 2 per cent inflation target. However, if the Canadian economy is close to the end of the current business cycle, it may not be possible, or even wise, for rates to rise a further 150 basis points from their current level. Further complicating matters, the US Federal Reserve is tightening as well, which the Bank may need to keep pace with to prevent the Canadian dollar from declining and adding further fuel to rising inflation pressures. We expect the Bank will raise its overnight rate to 1.75 per cent in October, with an outside chance of further rate hike in December, and to continue to tighten monetary policy in 2019.